Business

17 July 2020

Share

“It’s time to change!” by the Madnetwork consulting agency

The fascinating study by the MAD Network consulting agency examines the impact of the coronavirus crisis on the luxury market sector by sector. The section devoted to jewelry is entitled “It’s time to change!” And it lays out quite a comprehensive agenda…

By Sandrine Merle.

MAD Network, a consulting agency co-founded by Delphine Vitry (formerly of LVMH) and Jean Révis, carried out this study among 45 major European houses and distributors in China and the United States. The study is divided into four parts dealing with fashion, travel retail, beauty and jewelry. Rather than copying it wholesale I have selected a few highlights that can guide strategic thinking for brands (whatever their size), designers and readers who want to keep up with changes in the market.

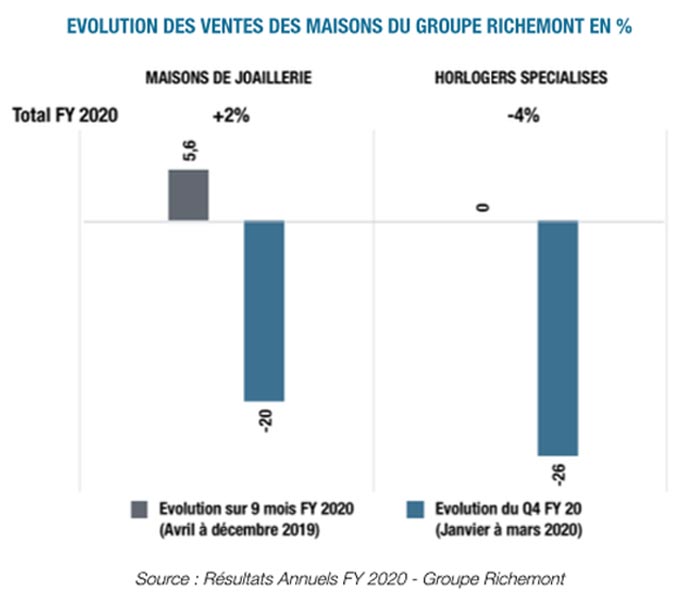

The jewelry industry has suffered enormously

“It is undoubtedly the luxury segment that has suffered the most from the crisis,” the study of MAD Network states, basing itself on the sales figures of the major groups. Take the results of LVMH for the first quarter of 2020. They are in free fall, with -26% for jewelry against -17% overall for the group. “But note, this situation is above all the consequence of a health crisis and does not call the business model into question”, says Delphine Vitry.

Catching up on digital technology

Jewelry suffered all the more as the penetration rate of e-commerce was 7 to 8% in 2019 against 20% for beauty and 12% for luxury as a whole. “Beyond e-commerce, the acceleration of digital is essential”: in communication, the delay has also been glaring while livesales (filmed sales) have proliferated in other sectors. In fact, most jewelers have remained in the shadows, except for Van Cleef & Arpels and Bulgari: on Instagram, Bulgari, for example, offered a Masterclass by artistic director Lucia Silvestri. The fact remains that jewelers still display little interest in cross-partnerships with other sectors, chats or live presentations.

Ever greater personalization

Digitalization should also make it possible to make up for lost time in the collection of customer data in order better to get to know them and meet their expectations. Something at which Amazon, for example, excels. We need to give them special treatment, pamper them, send them personalized emails, offer them unique experiences and exclusive products, or even deal with them one-to-one. The study of MAD Network advises drawing inspiration from the techniques of high jewelry sales staff, “an absolutely fascinating example of how to personalize customer relations”: it’s about knowing how to treat VICs (Very Important Customers) like real friends.

Accelerate “Direct-To-Consumer”

Retailers, multi-brand and concept stores have been extremely weakened. Barney’s, the famous American department store, has gone bankrupt! The study confirms that this mode of distribution (still 30% of sales in jewelry and 90% in watches) is declining sharply in contrast to retail, via a network of directly-operated stores. While retail enables direct contact with customers, the entry price is exorbitant: only the largest (Cartier, Van Cleef & Arpels, etc.) are capable of creating networks to “mesh” territories as vast as the US or China. Not to mention reaching Chinese cities such as Chengdu, Wuhan, Guangzhou, etc. where 60% of the Chinese middle class lives. To cater to such places the Richemont group has developed TimeVallée, a concept of boutiques grouping together several of its brands.

Rejuvenating the client base

The study points out that “the average age of the clientele of major jewelers often exceeds 35-40 years, an average that’s much higher than that of luxury clientele in general. “We must therefore rejuvenate it and attract Gen-Z! Another necessity is to attract customers back because, according to the study, ” each year the major houses make a large part of their sales to new customers. One of the recommended steps: attract them by adapting the offer to their tastes according to age, geographical area with more affordable collections, exceptional pieces, less intimidating boutiques, etc.”. A complex exercise, bordering on the schizophrenic.

Don’t count on Chinese tourists anymore!

It looks like bad news: “Chinese customers will remain the premier luxury customers for the next 5 years but they will concentrate their expenses in their country under the pressure of the government.” The major houses will therefore have to look for other growth levers such as the local clientele, which has been very neglected in recent years. Even if it will never be enough to compensate for the loss, knowing that before the crisis, European clients had a negative contribution of around 20% to the luxury market! Another avenue for MAD Network is to develop the pre-owned segment, i.e. the sale of antique pieces, which is currently monopolized by auction houses or pure players such as Collector Square.

“Nobody moves until they’re forced to,” concludes Delphine Vitry. Boldness and creativity are therefore more necessary than ever!

Banner video : Masterclass at home – By Bulgari with Lucia Silvestri

Related article: